Shipping & Logistics

Global Container Throughput

Based on IMF alternative GDP scenarios, Drewry depicted world port handling forecast. According to the British researchers, economic damage is skewed towards western countries, but most regions will face reduced container volumes. The pandemic has exposed the fragility of the supply chain and the strength of recovery will depend on economic rescue packages and consumer confidence. As a result, the global container handling market could sink by 12% this year and a further 6% next year.

In the first quarter of this year, while the overall cargo throughput of major Chinese coastal ports declined 3.5%,, container volumes at the eight major Chinese hub ports declined 8.9% year-on-year. According to the statistics released by China Ports & Harbors Association, in fact, the eight major Chinese ports reached a throughput of 37.63 million TEU container in Q1.

Container shipping market

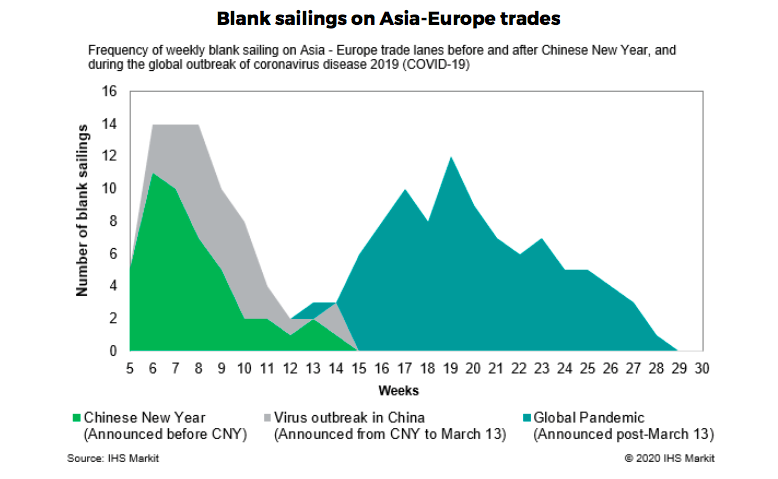

Container lines’ capacity appears to have stabilised after blanking more than 500 sailings since the outbreak of the coronavirus pandemic, with only a few new cancellations announced. According to Sea- Intelligence analyst, deep-sea trades reported only seven additional blank sailings last week, and capacity actually increased slightly because of larger ships being deployed.

The level of blanked capacity varies by trade lane, with the transpacific route seeing a 15%–25% reduction, while the Asia–Europe had just over 25% of its capacity removed. Asia–east coast South America, meanwhile, has seen capacity reduced by half. But when corrected against the number of blankings that would take place in a normal year, the amount of capacity set to be removed after the second quarter of the year has tailed off.

So far, no blank sailings have been announced for the third quarter yet, although analysts speculate that capacity withdrawal is expected to grow once more as it appears unlikely that demand will revert back to normal from July.

According to JOC, rapidly withdrawing capacity on east-west trades to prevent a rate collapse has been a highly successful strategy for carriers navigating the demand-crushing coronavirus disease 2019 (COVID- 19) that shut down the major markets of Europe and North America.

Despite rapidly weakening demand, so far the carriers have so far been able to sustain spot market rates at levels 25–40 percent above those of last year. As regards Far East-Europe routes, rates on China–North Europe were 14% higher last week and China-Mediterranean rates were 25% higher. Rates are decreasing only on the China–US East Coast, where they fell by 2.1%.

European Maritime Industry

According to a survey conducted by the ECSA (European Shipowners Association) about the impact of COVID pandemic on the shipping business, the European maritime industry does not expect a return to the pre-crisis level of activity during 2020. However, 65% of the interviewees think they will be able to keep the previous seafarers employment level.

From the environment point of view, only 26% of the sample believes that investments to reduce ship emissions will remain at pre-crisis levels, while 30% say that less resources will be invested, and 44% think that improving ship sustainability will no longer be a priority.

Similarly, only 11% of companies believe that fleet renewal programmes will resume after Covid-19, while 37% believe that investments will slow down and 52% consider to stop investing after the pandemic.

Ports of Genoa

Supporting measures to rail and intermodal transport

On last Friday 15th, the European Commission has approved, under EU State aid rules, Italian aid measures to support the shift of freight transport from road to rail in the area of the Port of Genoa.

The goal is to encourage the use of rail transport and intermodal solutions in the context of serious disruptions to the local transport network, severely impacted by the collapse of the Morandi bridge in August 2018.

The EU decision released an overall budget of €9 million, in the form of subsidies to logistics companies and multimodal transport operators, which have been able to maintain or to increase the share of freight transported by rail from and to the Port of Genoa over the 15 months following the collapse of the bridge. Support will also be granted, to the concessionaire of rail services in the Port of Genoa to compensate the additional costs borne due to the infrastructural disruption over the same period.

The Commission found that the aid is beneficial for the environment, as it supports rail transport and mobility, which is less polluting than road transport, while also decreasing road congestion. This is particularly important in this case due to the severe disruptions in traffic and connectivity experienced by the city of Genoa as a result of the collapse of the Morandi bridge in 2018.

The Western Ligurian Sea Port Authority trusts that this decision can become a first step towards a stronger role of public bodies to encourage and to govern the development of a more sustainable transport service between the Ports of Genoa and their hinterland.