Global Economic Trends

World trade

UNCTAD reports that the value of international trade in goods has declined by about 5 percent in Q1 2020 and is expected to decline further by 27 percent in Q2 2020, though the pace of contraction has slowed in May. Assuming persisting uncertainty, UNCTAD expects a decline of around 20 per cent for the year 2020, while World Trade Organization (WTO) expects the decline between 13 and 32 percent and European Commission expects that EU27 trade will decline by 10-16 percent.

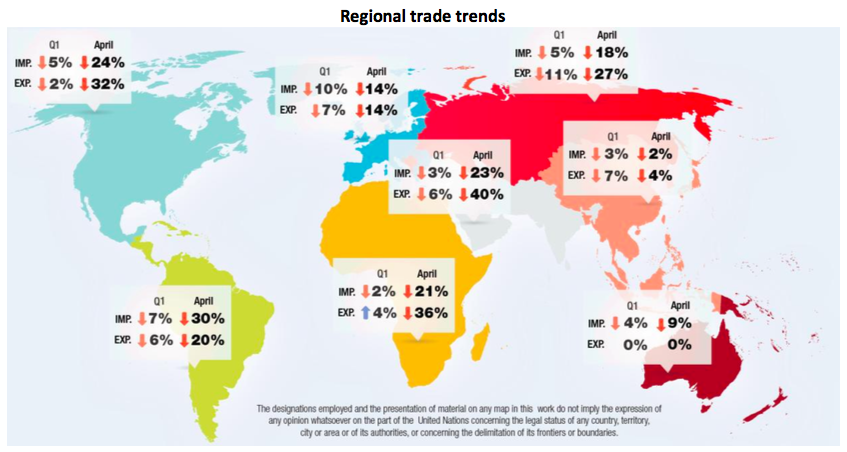

Trade in developing countries appears to have fallen faster in April relative to developed countries. For developing countries, while declines in exports are likely driven by reduced demand in destination markets, declines in imports may indicate not only reduced demand but also exchange rate movements, concerns regarding debt and shortage of foreign currency.

No region has been spared from the decline in international trade, however, trade in the East Asia and the Pacific regions appear to have fared better than other regions.

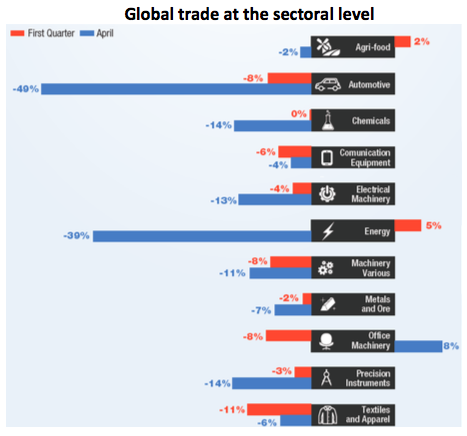

Economic disruptions brought by COVID-19 have affected some sectors significantly more than others. In the first quarter of 2020, textiles and apparel declined by almost 12 percent, while office machinery and automotive sectors have fallen by about 8 percent, while the agri-food sector increased by about 2 percent.

During April further declines affected most sectors and a very sharp contraction hit trade of energy and automotive products. In general, the variance across sectors has been driven by decreases in demand and disruptions of supply capacity and on disruption of global value chains due to COVID-19.

Shipping & Logistics

Container Shipping

As reported by JOC, consolidation over the past five years has reduced the number of major container carriers by half and grouped the remaining lines into three vessel-sharing alliances on the east-west trades between Asia, North America, and Europe, resulting in a higher frequency of sailings which allows carriers to adapt effectively to changing in terms of capacity management.

To match capacity with the falling bookings, carriers have extended the high levels of blanked sailings on Asia- Europe deep into the third quarter. Prior to June 1, the three alliances had canceled a total of 126 sailings between Asia and North America through August and 94 on Asia–Europe trades A further 75 sailings were canceled through September.

Thus, carriers have done a solid job balancing capacity with demand, and they are holding the fort so far, keeping rates up while costs have come down. There are no signs of carriers undercutting each other.

At its most basic level, the new normal means that rates will be higher going forward but instability will decline. This means carriers can finally look ahead to reasonable profitability, while shippers will not benefit from discounted rates, but they will get a higher degree of stability in terms of pricing and services offered.

As carriers return on a profitability path, some analysts think that rather than investing profits into bigger ships, companies will invest in technology and non-vessel-based shipping assets and might resume their ambition to develop their role along the supply chain business. From this point of view, even before the pandemic, Maersk had scaled back investment in new ships in recent years, investing instead in its vision of becoming an end-to- end global integrator of container logistics.

Whatever shape it takes, the post-COVID-19 future of container shipping may end up looking very different from its recent past.

Ports of Genoa

A new Border Control Post (BCP) is now available in the Port of Genoa, a SECH Terminal investment, located by the full-container facility’s stacking yard. BCPs are designated peripheral offices of the Ministry of Health, approved by the European Commission, for veterinary inspections of imported live animals and animal products entering the European Union.

The new 1000-sqm BCP building features two separate areas dedicated to products of human and non-human consumption, six container ramps and three refrigerated temperature-controlled storage facilities - minus 20°C/minus 2°C/room temperature - in addition to laboratories, offices and service areas. SECH Terminal’s designated BCP is equipped to accommodate approximately 50 containers per day and can be utilised by all the Genoa-Sampiedarena terminal operators to monitor both containerised and conventional cargo.

The high service quality facility, at the disposal of the public ministry officials, is set to speed up the veterinary controls which ensure that the imported live animals and animal products are safe and comply with EU legislation. The new opening represents an important step in the Western Ligurian Sea Port Authority’s firm commitment, alongside the port stakeholders, to build a smart and efficient port and strengthen the Ports of Genoa’s position as centre of cargo handling excellence, serving Italy and Europe’s leading industrial and consumer areas.