Global Trade

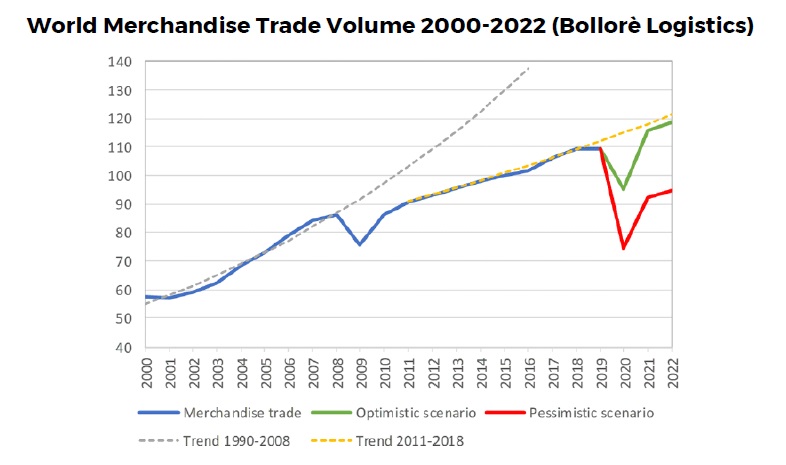

According to Bollorè Logistics Covid-19 Market Outlook, world trade is set to plummet up to 32% in 2020. Nearly all regions will suffer double-digit declines, with exports from North America and Asia hit hardest. Trade will likely fall steeper in sectors with complex value chains, particularly electronics and automotive products.

On the maritime side, Bollorè claims that thanks to the consolidation process of the last years, shipping lines are in a solid position to ride out the storm.

The number of cancelled sailings during the three first weeks of July’20 are 49% lower than same period in June’20 which shows that although carriers are still cutting capacity, the space availability should be improving in July. 8 sailings have been withdrawn on the Transpacific, Transatlantic & Asia-North Europe/Mediterranean trades in week 29 (13 July to 19 July 2020), 20% less than what has been announced for week 28. This brings the total cancellations for the first 3 weeks of July to 21, as opposed to 348 scheduled sailings (6%). The major cancellations remain on the Transpacific and Asia-N Europe & Med trade at more or less equal level.

Due to an increase in near-shoring, protectionism and a fracturing of the link economic growth and international trade, volumes are likely to be volatile in the short term; depressed in the medium term with little prospect of long term growth. Demand volatility, capacity shortages alternating to over-supply, as well as the financial risk of holding assets will all play a role in making the shipping sector unstable for some time to come.

Capacity planning will become exceptionally difficult, with the possibility that the Coronavirus will return at intervals, affecting economic growth, but also supply-side markets such as ports and trucking.

The rebalancing of the industry on regional volumes and the lower intercontinental volumes will militate against super-sized container ships. Shipping lines may pivot to smaller vessels able to call direct at more ports. This trend will be reinforced as manufacturers in the West increase the number and geographical diversity of their suppliers throughout Asia, Africa and Latin America.

Furthermore, the oil cost is expected to remain low for sometime to come and this will be a big benefit to the shipping industry which had viewed the impact of IMO 2020 low sulphur regulations as a threat.

Transport Sustainability

Supply chains and alternative fuels

Bollorè highligthed that during the period of lockdown an enormous decrease in pollution has been registered and this might push politicians to approach global climate emergency through similar measures. The analysts think that the availability of public subisidies to prevent bankruptcy will give industries more leverage over sustainability targets, although the low cost of fuel will make investment decisions in more efficient engines more difficult.

The introduction of alternative fuels in the logistics sector will require investment in new technologies and in supply networks. Vehicle manufacturers might use the crisis as a catalyst to close down loss-making factories and re-focus on new propulsion systems, with a systemic impact on regional supply chains. The deployment of zero-emissions engines might be accelerated through the likely introduction of new diesel bans, which will create the demand for smaller intra-urban and urban logistics networks, making supply chains less efficient.

Reduction of shipping emissions

Carbon emissions from the maritime sector could be included in the European Union’s carbon market for the first time. Lawmakers on the environmental committee of the European Parliament have voted on a set of reforms to the EU’s monitoring, reporting and verification regulation, which dictates rules for collection of fuel and emissions data from ships calling at the bloc’s ports. Under the reforms, maritime should become part of the EU Emissions Trading System, the bloc’s tool for capping permitted carbon emissions and allows for trading of allowances.

Shipping could also face binding targets to cut ships’ annual average carbon intensity by at least 40% by 2030 compared with a baseline year yet to be decided and, based on current data, the rules would affect around 11,000 vessels. The parliament’s full legislative assembly will vote in September on whether to approve the rules that would impose the world’s first major legally binding greenhouse gas emissions requirements on ships and force shipowners to pay for excess emissions in the EU.

Ships calling at EU ports are also expected to emit no GHGs by 2030 when at berth.

Ports of Genoa

Supporting measures to rail and intermodal transport

On June 30, the Ports of Genoa steering committee approved the measures to support rail and intermodal transport. The resolution adopted during the assembly authorises the allocation to five rail companies of a total of approximately €1.7 million, with the double purpose of support and stimulus to a sector affected by the collapse of the Morandi Bridge. In addition, in a period of severe congestion along the motorways leading into Genoa, an increase in rail or intermodal transport can also contribute to an overall reduction in congestion and air pollution generated by road transport.

The resolution guarantees subsidies to the logistic companies and multimodal transport operators which have maintained or increased the share of freight transported by rail to/from the Port of Genoa over the 15 months following the collapse of the bridge. Aid will also be granted to the concessionaire of rail services in the Port of Genoa to compensate the additional costs borne due to the infrastructural disruption over the same period.

Despite a range of strategic construction works underway to improve the port’s rail connections, that also implicate a temporary reduction in capacity, in 2019 over 127,000 railway wagons were handled to/from the Port of Genoa, with an increase of around 2,000 wagons compared with 2018.