Global Economic Trends

UK-headquartered global analysts Oxford Economics released an in-depth analysis of the global economic momentum. In response to the first signs of successful coronavirus containment, some governments begin to explore lifting lockdown restrictions. Still, the latest economic data confirm that the economic costs of shutdowns are and will be significant.

China’s GDP performed better than estimated, falling by 6.8% in Q1, but the pace of improvement in March was quite slow. In the US the monthly industrial output dropped 5.4% and retail sales plunged 8.7% in March, signals that the adverse effects of lockdowns may prove even larger than predicted and it seems highly likely that activity will contract even more sharply in April.

As social distancing is likely to remain the primary tool for containing the virus for some time yet, implying only a very gradual easing of restrictions, Oxford Economics’ forecast for 2020 remains pessimistic indicating a 2.8% decline of global GDP, just a touch stronger than the latest IMF estimate.

Shipping & Logistics

According to JOC, despite sharply declining demand for Asian imports from European countries locked down amid the coronavirus disease 2019 (COVID-19), freight rates in recent weeks have remained consistently above year-ago levels.

Thanks to recent consolidation in the carrier sector, the fewer carriers in three alliances have been better able to manage capacity-cutting response to fast-weakening demand, withdrawing up to 30 percent of capacity from the Asia-Europe trade through June.

Thus, spot rates assessed by the Shanghai Containerized Freight Index (SCFI) were at $725 per TEU on April 17, 10% higher than the same time last year and down only by $79 per TEU in the last seven weeks. Nevertheless, a steady decline is expected in the future the longer the weak demand lasts, due to the likely severe eurozone recession.

Ship building industry

Seatrade Maritime published on April 20 “Coronavirus, Climate Change & Smart Shipping - Three Maritime Scenarios 2020 – 2050”, a white paper by Dr Martin Stopford (President Clarkson Research) which focuses on the future of the ship building industry.

Mr Stopford claims that the coronavirus pandemic adds uncertainty to the weak shipping industry market of the beginning of the new decade, characterised by orders about 75% down.

Nevertheless, the pandemic storm might be a catalyst for the radical measures needed to renovate the cargo fleet in the next 20 years with the radical technologies now available, addressing big issues as climate change and the digital revolution and leading to the biggest change in ship design since steam replaced sail in the 19th century.

According to Mr Stopford, although global trade will slowdown and new ship requirements will decline over the next two or three years, new shipbuilding demand will grow, focusing on the re-design and re- engineering of cargo ship systems in response to climate change and smart shipping.

Mr Stopford concludes that notwithstanding the inevitable recession due to the Covid-19 pandemic, the shipbuilding industry has the opportunity to build a fleet of robust and commercially viable ships, incorporating innovating mechanical, electrical and digital equipment technology.

The further innovation will be pushed forward, the highest outcomes will be reached in terms of progressing the transition to smart ship design and climate friendly sea transport and meeting ship emissions and efficiency goals.

Ports of Genoa

Northern Italy Market Study

SRM (Intesa San Paolo Group research center) and Contship presented the findings of a survey conducted among a wide number of manufacturing companies sampled out of three Northern Italy regions: Lombardy, Emilia Romagna and Veneto, which together cover 40.7% of Italian GDP and 53% of the Italian import/export market (of which about 30% by sea).

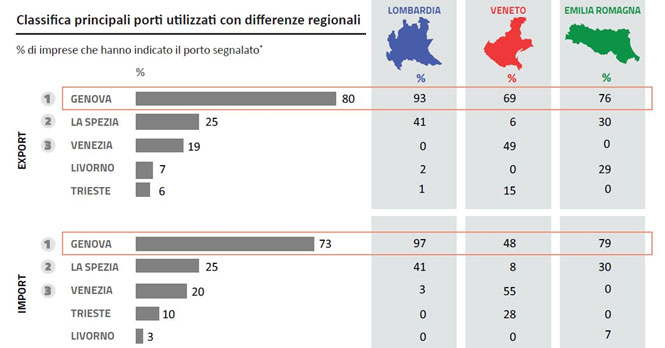

Genoa consolidates its position as the most commonly used port, followed by the other Ligurian Port of La Spezia, with lower shares for the Ports of Venice, Trieste and Livorno. The Port of Genoa reaches a utilisation factor of 80% (it was 72% in 2018) on exports and 73% (55% in 2018) on imports, exceeding 90% among Lombard companies and 75% among those from Emilia.

Europe and Asia rank as the two main trading partners for the sampled companies: Europe prevails in exports (50%) over Asia (37%), followed by the Americas (29%), vice versa on imports Asia (50%) prevails over Europe (39%) and the Americas (20%).

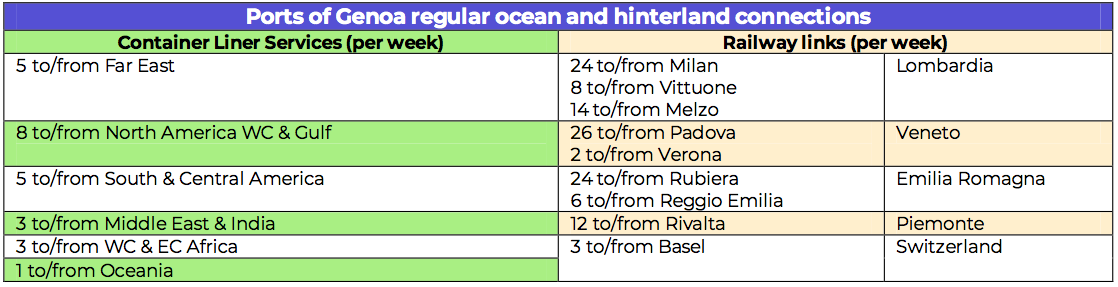

The predominance of Ligurian over Adriatic ports is related to the wide selection of regular liner shipping services to worldwide destinations, offered by all the major shipping companies and alliances and to the broad offer of railway connections with the main intermodal centres in Northern Italy.

Two out of three companies choose the Ex Works sales method and outsource logistics, aiming to reduce operating costs and investments in buildings, plants, facilities and personnel. In this way, the cargo shipment logistics, from the filling of the container to the delivery, is handled by freight forwarders selected by the buyer at destination. Thus Italian companies lose control of the supply chain, saving costs but running the risk that goods may follow non-optimal logistics paths.

Intermodal transport is adopted only by 17% of companies (down from 19% in 2018) and only 16% of the companies interviewed include sustainability among their priorities.

The study also assessed the companies’ satisfaction over the quality of logistics services, which on average is 7.59 (on a scale of 10) and ranges from a minimum of 7.46 for the railway service, to 7.67 for the size and accessibility of infrastructures.