Global Economic Trends

China’s economic indicators

Recently, Chinese Government released several economic indicators for the month of May: the industrial production was up as was investment in property and infrastructure. The retail sales were down and weaker than expected and overall investment continued to fall.

China’s economy is reviving faster than Europe’s and the United States’ ones, but activity mostly remains below pre-COVID-19 levels.

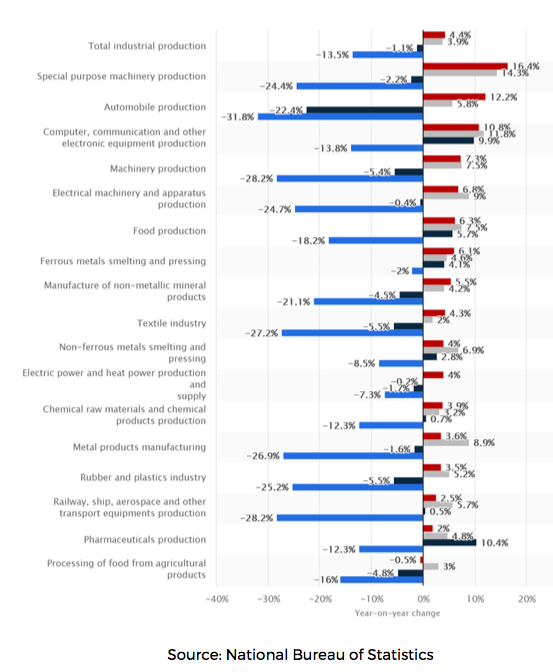

In May the industrial production grew by 4.4% vs 2019, up from 3.9% growth in April. Manufacturing output was up 5.2%, including a 12.2% increase in the automotive sector. A strong growth was registered in the production of construction equipment due to government increased spending on infrastructure.

China’s government reported that retail sales fell by 2.8% in May. However, some categories experienced significant increases from 2019. Sales of oil and related products were down sharply while sales of apparel were down modestly.

China’s industrial production

Shipping & Logistics

Container Shipping

The container volume of eight major China’s ports grew by 2.5% year-on-year during the period of mid-June. Consequently, the cargo throughput was up 2.4%.

Chinese exports of containers increased by 0.2%. The growth rate of Xiamen port, Guangzhou port, and Shenzhen’s Yantian port exceeded 10%.

Ports of Genoa - Jan-May Traffic Trend

COVID-19 have affected some sectors significantly more than others.

Container traffic

In May port container throughput fell off by 26%, registering a total of 176.352 TEU, 7.352 TEU more than the forecast. The sector registers a total loss of 7% in the Jan-May period, in line with Drewry’s forecast of - 9% global container handling drop for 2020.

As per full container exports, a contraction is confirmed in line with April (-20.1%), while imports suffer a sharp setback, much more significant than the previous month (-30.8% vs -12.9%).

- In Genova, as expected, PSA Genova Prà terminal reported a -32.5% decline in May (45.343 TEU), together with SECH terminal that showed a dramatic 42.3% fall (-13.439 TEU).

- PSA Terminal June’s throughput projection is in line with May, while SECH plans to recoup January levels.

- In Savona, the new Vado Gateway terminal confirmed the trend registered over the 4 previous months of operation, contributing to double the container volumes of the port of Savona Vado compared to last May, while Reefer Terminal registered a steep downturn in its throughput, losing 41.8% in the month, but remaining in line with 2019 in the cumulative period.

General Cargo

Conventional cargo volumes, as projected, are slightly recovering in May (-30.4% vs -44% in April), with 932.903 tonnes. More than 630,000 tonnes were handled by the port of Genoa that signed a -29.9% from a year earlier. Forest products and cellulose traffic recorded an excellent performance, doubling the results for the same period of 2019, thanks to the expansion of the Forest Terminal’s warehouse.

Bulk cargo

Liquid bulk recovered 7.2 percentage points compared to April, registering a -37.3% fall, since oil products demand is growing in regions which started easing locking measures, and Porto Petroli terminal’s expectations for June are to rise again to March volumes.

The dry bulk trade posted unprecedented decline since the beginning of the year, contracting by 57.8%, mainly because of the lower commodity demand as a direct result of the economic slowdowns.

Passengers

The passenger market counted only 9.338 (ferry) passengers in May 2020, 97.2% less than in the corresponding month of last year. The total for cruise traffic in the first five months of 2020 dropped by 74.6%, while ferries decreased by 61.4%. This major decline was due to the ongoing travel restrictions caused by the stop in the cruise industry and the limited ferry services between the mainland and the major Italian islands.